estate trust tax return due date

If you wind up a graduated rate estate the tax year will end on the date of the final distribution of the assets. 31 rows Generally the estate tax return is due nine months after the date of death.

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

It depends on the.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

. 13 rows Only about one in twelve estate income tax returns are due on April 15. Ad Pursue Your Vision for the Future With Estate Planning From Bank of America Private Bank. Over 19 Years of Experience.

Form 1120S for S-corporations 15th March. Ad Over 19 Years of Experience. For example for a trust or estate.

Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year. According to the IRS estates and trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year. The form to file is 1041 the income-tax return for trusts and estates.

The decedent and their estate are. Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040 1040-SR. The federal fiduciary income tax return is typically due by the 15th day of the 4th month following the end of the estates taxable year.

Schedule K-1 Form 1041 InstructionsCorrected Decedents Schedule K-1 -- 29-JAN-2021. Over 19 Years of Experience. For trusts operating on a calendar year the trust tax return due date is April 15.

Federal estate tax returns are due no later than 9 months. If you wind up an inter vivos trust or a testamentary trust other than a graduated. File an amended return for the estate or trust.

For trusts on a fiscal year the trust tax return filing deadline is the 15th day of the fourth month. Due Date for Estates and Trusts Tax Returns. Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year.

Income Tax Return for Estates and Trusts. If you pick Dec. Form 706 must generally be filed along with any tax due within nine months of the decedents date of death.

31 for instance that gives you until April 15. Ad A Checklist for Trust Funds Organizing Your Financial Documents. The extension is automatic.

The estimated tax is payable in equal installments on or before April 15 June 15 September 15 and January 15. When the estate or trust. Whatever date you set for the end of the.

Please note that the. The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six. Form 4868 doesnt need to be filed if no tax is due.

IRS Form 1041 US. More In File Form 1041. Form 1041.

For example for a trust or. California Fiduciary Income Tax Return form FTB 541 California Fiduciary Income Tax Return booklet FTB 541. Due Date for Estates and Trusts Tax Returns The return is required to be filed on or before April 15 if on a calendar year basis and on or before the 15th day of the fourth month.

Form W-2 W3 1099 NEC and 1096 NEC. Ad Over 19 Years of Experience. The first payment for a fiscal year filer must be filed on or before the 15th day.

3 However not every estate needs to file Form 706. The return is required to be filed on or before April 15 if on a calendar year basis and on or before the 15th day of the fourth month following the. Make sure that you tick the Final Return box on the face of the return.

Due Date For Filing. Form 1065 for Partnerships 15th March 2022. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income.

Request Our Free Estate Planning Documents free Financial Information You Need. Ad Pursue Your Vision for the Future With Estate Planning From Bank of America Private Bank. And in case you think the IRS may miss that little box feel free to also write Final Return across the top of.

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

The Generation Skipping Transfer Tax A Quick Guide

Distributable Net Income Tax Rules For Bypass Trusts

Distributable Net Income Tax Rules For Bypass Trusts

Michigan Real Estate Power Of Attorney Form Power Of Attorney Form Power Of Attorney Power

Common Types Of Trusts Findlaw

Here Are The 4 Most Important Terms To Include In A Contract Contractlaw Massachusettslaw Contract Law Contract Law

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Confidentiality Agreement Legal Forms Being A Landlord Letter Form

Land Trust Agreement Real Estate Forms Land Trust Real Estate Templates

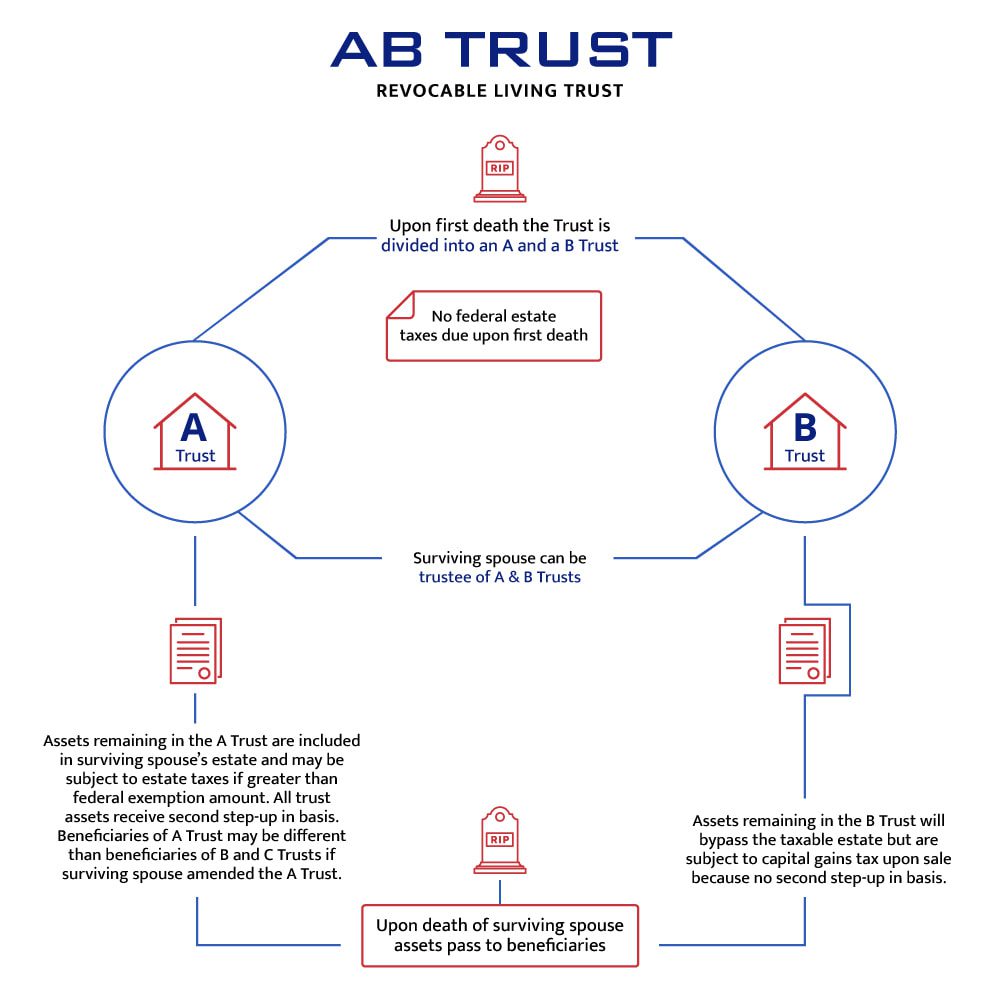

To A B Or Not To A B That Is The Question Botti Morison

Probate Process Probate Timeline Inheritance Process Probate Timeline Insurance Benefits

Exploring The Estate Tax Part 2 Journal Of Accountancy

The Generation Skipping Transfer Tax A Quick Guide

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide